Unwinding the PHE

Continuous enrollment condition

Unwinding the COVID-19 Public Health Emergency

The Consolidated Appropriations Act of 2023 (CAA), signed by the President on December 29, 2022, decoupled the unwinding of the Medicaid continuous enrollment condition and the 6.2% enhanced federal medical assistance percentage (FMAP) that were both previously tied to the end of the federal coronavirus disease 2019 (COVID-19) public health emergency (PHE).

States will now face an unprecedented volume of Medicaid and CHIP eligibility renewals. This requires careful planning in order to comply with statutory requirements, to transition ineligible individuals to other coverage, and to protect those eligible individuals most at-risk of losing coverage due to “administrative churn” (children and people of color). The resumption of renewals is expected to have a material impact on expected costs for state Medicaid programs and downstream managed care entities (see the “Rate Setting Implications” section).

Background

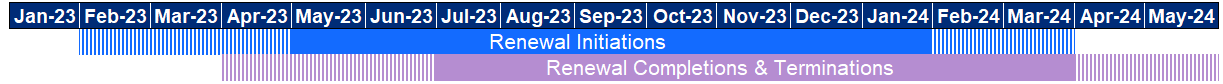

The Families First Coronavirus Response Act (FFCRA), passed in 2020, allowed states to receive an additional 6.2% enhancement to their Medicaid FMAP through the end of the PHE. As a condition of receiving this enhanced FMAP, states could not terminate enrollment for most individuals enrolled in Medicaid during the PHE. The CAA severed the link between the end of the PHE, the continuous enrollment condition, and the timing of enhanced FMAP. Specifically, CAA Section 5131:

- Ends the continuous enrollment condition effective March 31, 2023

- Extends and phases down enhanced FMAP through the end of 2023

- Reaffirms CMS guidance and requires states to comply with all federal renewal requirements

- Implements additional requirements for updating contact information and dealing with returned mail

- Institutes new reporting requirements and establishes additional transparency, accountability, and enforcement authority

Subsequent to the passage of the CAA, the federal government announced on January 30 that the PHE will end on May 11, 2023. This does not affect the unwinding of the continuous enrollment condition or the phase down of the 6.2% enhanced FMAP outlined in the CAA. However, it does impact many other provisions that remain in place from the FFCRA and from the American Rescue Plan Act of 2021 (ARPA) that remain tied to the PHE end date. For example, the unwinding of certain home- and community-based services (HCBS) and emergency waiver authorities granted by CMS during the PHE, as well as the enhanced FMAP available for COVID-19 vaccine administration costs introduced by ARPA, were not changed by the CAA, but are affected by the end of the PHE timing.

What is at Stake?

Total Medicaid/CHIP enrollment grew to over 90.9 million as of September 2022, an increase of 28% over February 2020.

The overall enrollment increases may reflect economic conditions related to the pandemic, the adoption of the Medicaid expansion under the Affordable Care Act in several states (Nebraska, Missouri, and Oklahoma), as well as the continuous enrollment condition included in the FFCRA. Statutory changes enacted under the CAA decouple the Medicaid continuous enrollment condition from the PHE and terminate this provision on March 31, 2023. As of April 1, 2023, states have been able to begin Medicaid disenrollment of populations determined ineligible.

The Department of Health and Human Services (HHS) estimates that as many as 15 million people will be disenrolled from Medicaid/CHIP as a result of unwinding the continuous enrollment condition. This includes up to 6.8 million who may still be eligible but will be disenrolled, at least temporarily, due to “technical reasons” related to difficulty navigating the administrative aspects of the renewal process (“administrative churning”). HHS predicts that administrative churn will disproportionately affect children and people of color, resulting in more disruptions in Medicaid coverage for these groups.

Unwinding the Continuous Enrollment Condition

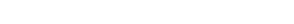

The CAA ended the continuous enrollment condition effective March 31, 2023, and states are allowed 12 to 14 months to disenroll ineligible members, depending on when a state initiates the member renewal process. States are allowed to work through the process on a faster timeline, within certain limitations:

- States must initiate the member renewal process between February 2023 and April 2023. Given the 60-day minimum window that states must allow for members to respond to renewal notifications (some states allow for more than 60 days), no members can have eligibility terminated prior to April 1, 2023.

- Once started, all renewal determination initiations must occur within a 12-month timeframe, or by March 31, 2024 (whichever occurs first).

- States cannot process renewals for more than one-ninth of overall enrollment in any given month.

- An additional two months is allowed for completing renewals and terminations. For example, a state that initiates the renewal process in April 2023 must complete all renewal initiations by March 31, 2024, and would have until May 31, 2024 to complete all renewals and terminations.

Illustration of 12-14 Month Timing of Renewal Initiations and Completions

(Hashed lines indicate state flexibility in renewal timing)

Enhanced FMAP Conditions and Phasedown

Receipt of the enhanced FMAP from April through December 2023 will be contingent upon states meeting the existing FFCRA requirements barring the implementation of more restricting eligibility/enrollment standards and increased premiums, as well as requirements added in the CAA:

- States must comply with all federal renewal requirements, take steps to update enrollee contact information, and make a good-faith effort to contact enrollees using methods in addition to mail before terminating coverage for returned mail.

Rate Setting Implications

For most Medicaid managed care rate setting work, the unwinding of the continuous enrollment condition is an important issue, likely resulting in large reductions in the overall size of Medicaid-covered populations across states, and potentially large shifts in the cost and acuity of the remaining covered lives compared to recent history. The impact of unwinding should be an explicit consideration in most Medicaid rate development work over the next several years as the unwinding continues to affect both the rating period and historical base data periods used for rate development.

Unwinding the PHE is expected to result in increased year-over-year per member per month (PMPM) claims costs for Medicaid programs and managed care plans. To determine the potential impact, we must examine factors expected to contribute to the projected increases in PMPM claims costs:

1. Lower acuity of disenrolled members

Unwinding is expected to disproportionately affect Medicaid “churn” populations, which includes members that have historically shown lower PMPM costs than longer-term Medicaid members within the same rating group.

2. Return of “gap months”

The ending of the continuous enrollment condition under the FFCRA will lead to the return of “gap months”, where some Medicaid enrollees will lose coverage for a few months due to administrative churn, only to return shortly thereafter. In terms of claim cost PMPM buildup, excluding these gap months in coverage can eliminate substantial member months in the denominator of the PMPM calculation, but have little to no claim costs impact in the numerator, therefore exerting an aggregate upward pressure on overall PMPM costs.

Note that the CAA introduced new continuous eligibility requirements for children starting in 2024, which may result in fewer gap months for this population compared to pre-PHE levels. Also, some states are activity working on reducing gap months for some populations through renewal timing, eligibility and other policy changes, and IT system updates. Considerations should be taken to ensure the state-specific circumstances are used when evaluating the impact of gap months.

3. Accelerated demand by enrollees nearing disenrollment

Members will generally have 60–90 days to respond to renewal notices. For members losing coverage due to ineligibility, there may be an acceleration in health care spending in the last one to two months prior to coverage termination. The impact on utilization and spending patterns associated with this behavior has largely been absent during the PHE due to the pause on coverage termination.

4. Reduction in the number of members with other primary coverage

Members that obtained other non-Medicaid coverage during the PHE may not have notified states of this change in coverage. This could lead to some members with third-party liability coverage being enrolled in managed care that otherwise should not be, resulting in reductions to PMPM costs over the duration of the PHE. With resumption of renewals and terminations, states may see a reshuffling of enrollees by eligibility categories and rate cells such that overall PMPM costs may increase.

5. A new normal – enrollment and acuity mix

After all renewals and terminations have been completed, the enrollment and acuity mix going forward may be different from pre-COVID-19 levels. These shifts are more likely to occur in states that have undergone the greatest economic shifts or those states that have enacted system/eligibility changes likely to effect the frequency of gap months.

6. Impact of disenrollment volume across the rating period

States will each plan for and experience different approaches and results related to the number of individuals disenrolled each month during the transitional rating periods on or after April 1, 2023. An estimated number of total potential individuals disenrolled, along with an assumed pattern of disenrollment by month or quarter, will need to be considered to evaluate an average impact across the given rating period. State-specific details should be considered for the unwinding plan to ensure alignment of those plans and rate development assumptions.

Risk Mitigation Strategies for PHE Unwinding

Unwinding contributes more uncertainties now than in typical years, at both the statewide and managed care entity levels. Even if states are able to estimate statewide impacts with some level of accuracy, plan-specific experience will likely vary widely due to different levels of disenrollment and the associated acuity shifts.

Given the potential shifts that may result from unwinding the PHE, it is important for states to consider the risks and uncertainties related to the unwinding and plan accordingly. States may want to consider options for responding to significant deviations in actual results compared to pricing expectations, such as:

- Pre-planning for mid-year rate updates

- Implementing risk corridors prior to the start of the rating year

- More frequent prospective risk adjustment, such as quarterly or semi-annual rather than annual

- Consider implementing retrospective/concurrent risk adjustment to capture plan-specific variance in disenrollment and acuity levels over the next several years, even for states that do not normally utilize retrospective methodologies

These tools allow states flexibility to account for material deviations in actual to expected experience after gaining more insight related to the unwinding impact after it has started.

Caveats and limitations

Mercer is not engaged in the practice of law, or in providing advice on taxation matters. This report, which may include commentary on legal or taxation issues or regulations, does not constitute and is not a substitute for legal or taxation advice. Mercer recommends that readers secure the advice of competent legal and taxation counsel with respect to any legal or taxation matters related to this document or otherwise.

Questions for your specific state?

Please contact Scott Katterman or your Mercer consultant to discuss the impact of this change for your specific state programs. You may also email us at mercer.government@mercer.com.

View more information at https://www.mercer-government.mercer.com

Want to download this FLASH?

Is this content exactly what you need and you are interested in downloading the document? Feel free to click below to save a PDF of the contents.

Stay informed

Subscribe to updates on public health, Medicaid and other critical topics for states.